Quantum Annealing Hardware Manufacturing Market Report 2025: In-Depth Analysis of Growth Drivers, Technology Innovations, and Competitive Dynamics. Explore Key Trends, Forecasts, and Strategic Opportunities Shaping the Industry.

- Executive Summary & Market Overview

- Key Technology Trends in Quantum Annealing Hardware

- Competitive Landscape and Leading Manufacturers

- Market Growth Forecasts (2025–2030): CAGR, Revenue, and Volume Projections

- Regional Analysis: North America, Europe, Asia-Pacific, and Rest of World

- Future Outlook: Emerging Applications and Investment Hotspots

- Challenges, Risks, and Strategic Opportunities

- Sources & References

Executive Summary & Market Overview

Quantum annealing hardware manufacturing is a specialized segment within the broader quantum computing industry, focused on the design, fabrication, and commercialization of quantum processors optimized for solving combinatorial optimization problems. Unlike gate-based quantum computers, quantum annealers leverage quantum tunneling and superposition to find low-energy solutions to complex problems, making them particularly attractive for logistics, finance, and material science applications.

As of 2025, the global quantum annealing hardware market is characterized by a small number of pioneering manufacturers, with D-Wave Systems Inc. remaining the most prominent commercial supplier. D-Wave’s Advantage system, featuring over 5,000 qubits, has set the benchmark for annealing-based quantum processors, and the company continues to expand its manufacturing capabilities to meet growing enterprise and research demand. Other notable players, such as Fujitsu and Toshiba, have entered the market with digital annealing solutions and hybrid quantum-classical systems, further intensifying competition and innovation.

The market’s growth trajectory is underpinned by increasing investments from both public and private sectors. According to IDC, global spending on quantum computing hardware, including annealing systems, is projected to surpass $2.5 billion by 2025, with a compound annual growth rate (CAGR) exceeding 30%. This expansion is driven by the technology’s potential to deliver quantum advantage in real-world optimization tasks, as well as by strategic partnerships between hardware manufacturers, cloud service providers, and end-user industries.

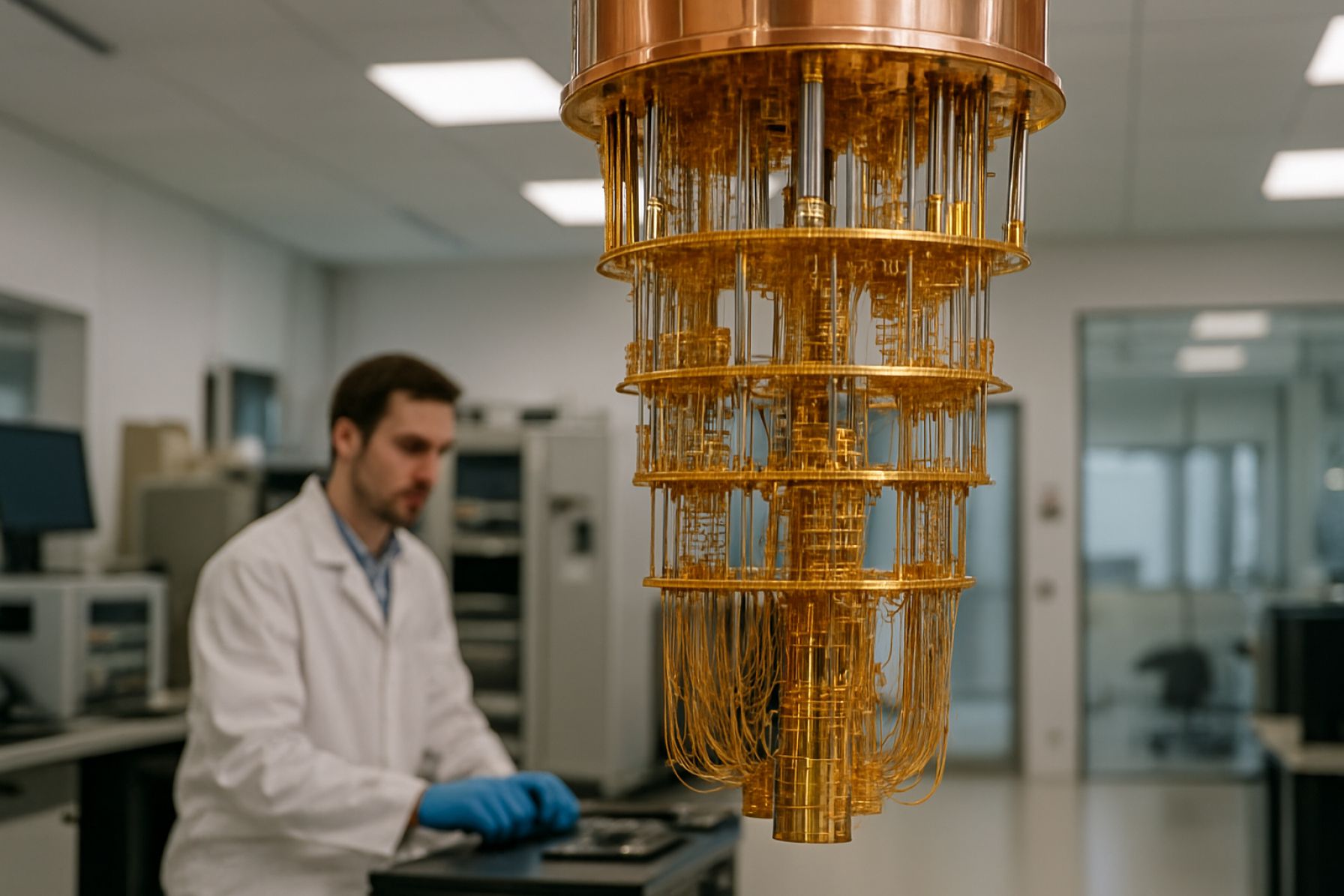

Manufacturing quantum annealing hardware presents unique challenges, including the need for ultra-low temperature environments, advanced superconducting materials, and highly specialized fabrication processes. The supply chain remains concentrated, with a handful of vendors providing critical components such as dilution refrigerators and superconducting circuits. As a result, scalability and cost reduction are central concerns for manufacturers seeking to broaden market adoption.

In summary, the quantum annealing hardware manufacturing market in 2025 is defined by rapid technological progress, increasing commercialization, and a competitive landscape shaped by a few key players. Ongoing advancements in qubit coherence, system integration, and manufacturing efficiency are expected to further accelerate the sector’s growth and its impact across multiple industries.

Key Technology Trends in Quantum Annealing Hardware

Quantum annealing hardware manufacturing in 2025 is characterized by rapid innovation in materials science, chip architecture, and fabrication processes, driven by the need for increased qubit coherence, scalability, and commercial viability. The sector is led by companies such as D-Wave Systems, which continues to refine its superconducting qubit technology, and new entrants exploring alternative approaches like photonic and spintronic annealers.

One of the most significant trends is the transition from niobium-based superconducting circuits to advanced materials such as tantalum and vanadium, which offer improved coherence times and reduced noise. This shift is supported by research collaborations between hardware manufacturers and academic institutions, aiming to overcome the decoherence and crosstalk challenges that have historically limited qubit performance and system scaling.

Manufacturers are also investing in three-dimensional (3D) integration techniques, allowing for denser qubit layouts and more efficient interconnects. This approach, inspired by developments in classical semiconductor manufacturing, enables the stacking of multiple chip layers, reducing footprint and enhancing signal integrity. IBM and Intel have both reported progress in 3D packaging for quantum processors, although their primary focus remains on gate-based quantum computing, their innovations are influencing annealing hardware as well.

Another key trend is the automation of cryogenic testing and calibration. As quantum annealers require operation at millikelvin temperatures, manufacturers are deploying automated test benches and AI-driven calibration routines to accelerate production cycles and improve device yield. This is particularly important as the industry moves toward systems with thousands of qubits, where manual calibration becomes impractical.

Supply chain resilience is also a growing focus. The reliance on specialized cryogenic components and high-purity materials has prompted manufacturers to diversify suppliers and invest in in-house capabilities. For example, D-Wave Systems has expanded its partnerships with cryogenics firms and material suppliers to mitigate risks associated with global supply chain disruptions.

Looking ahead, the convergence of quantum annealing hardware manufacturing with advanced semiconductor processes, such as extreme ultraviolet (EUV) lithography and atomic layer deposition, is expected to further enhance device performance and scalability. These trends collectively position the industry for broader commercial deployment and integration into hybrid quantum-classical computing environments by the late 2020s.

Competitive Landscape and Leading Manufacturers

The competitive landscape for quantum annealing hardware manufacturing in 2025 is characterized by a small number of highly specialized players, each leveraging proprietary technologies and strategic partnerships to secure market share in this nascent but rapidly evolving sector. The market is dominated by a handful of companies, with D-Wave Systems Inc. maintaining a clear leadership position due to its early commercialization of quantum annealers and continued advancements in qubit scaling and error reduction.

D-Wave Systems Inc. remains the only company with commercially available quantum annealing systems, such as the Advantage system, which features over 5,000 qubits and is accessible both on-premises and via cloud-based quantum computing services. D-Wave’s focus on improving connectivity, coherence times, and integration with classical computing infrastructure has solidified its role as the primary supplier for industries exploring optimization, logistics, and machine learning applications.

Other notable entrants include Fujitsu Limited, which has developed the Digital Annealer—a quantum-inspired hardware platform that emulates quantum annealing processes using classical semiconductor technology. While not a true quantum device, the Digital Annealer competes in similar application domains and is often considered a bridge technology for enterprises preparing for full-scale quantum adoption.

Emerging startups and research-driven organizations are also entering the field, often focusing on novel qubit materials, cryogenic engineering, and hybrid quantum-classical architectures. For example, Toshiba Corporation has announced research initiatives in quantum annealing, aiming to develop hardware that can address specific combinatorial optimization problems. However, these efforts remain largely in the prototype or proof-of-concept stage as of 2025.

The competitive dynamics are further shaped by strategic collaborations between hardware manufacturers and cloud service providers, such as Google Cloud and Microsoft Azure Quantum, which offer access to quantum annealing hardware via cloud platforms. These partnerships are critical for expanding user access, accelerating software ecosystem development, and driving early commercial adoption.

Overall, the quantum annealing hardware manufacturing sector in 2025 is marked by high barriers to entry, significant R&D investment, and a strong emphasis on ecosystem partnerships, with D-Wave Systems Inc. retaining a dominant position while new entrants and established technology firms seek to carve out niche roles in the evolving market.

Market Growth Forecasts (2025–2030): CAGR, Revenue, and Volume Projections

The quantum annealing hardware manufacturing market is poised for significant expansion between 2025 and 2030, driven by increasing investments in quantum computing research, growing enterprise interest in optimization solutions, and advancements in quantum processor fabrication. According to projections by International Data Corporation (IDC), the global quantum computing market—including hardware, software, and services—is expected to surpass $8.6 billion by 2027, with quantum annealing hardware representing a substantial share due to its commercial maturity and early adoption in logistics, finance, and materials science.

Specifically, the quantum annealing hardware segment is forecasted to achieve a compound annual growth rate (CAGR) of approximately 28% from 2025 to 2030, outpacing the broader quantum computing hardware market. This robust growth is underpinned by the scaling of production capabilities by leading manufacturers such as D-Wave Systems Inc., which continues to commercialize next-generation quantum annealers with higher qubit counts and improved coherence times. Market revenue for quantum annealing hardware is projected to reach $1.2 billion by 2030, up from an estimated $320 million in 2025, reflecting both increased unit sales and higher average selling prices as performance improves and new use cases emerge.

In terms of volume, annual shipments of quantum annealing processors are expected to grow from fewer than 100 units in 2025 to over 500 units by 2030, as reported by Gartner. This volume growth is largely attributed to the expansion of cloud-based quantum computing services and the integration of quantum annealers into hybrid classical-quantum workflows, which lower the barriers to adoption for enterprise customers. Additionally, government-backed initiatives in North America, Europe, and Asia-Pacific are anticipated to further stimulate demand by funding research consortia and pilot deployments in sectors such as transportation, energy, and pharmaceuticals.

- CAGR (2025–2030): ~28%

- Revenue Projection (2030): $1.2 billion

- Volume Projection (2030): 500+ units shipped annually

Overall, the quantum annealing hardware manufacturing market is set for accelerated growth through 2030, supported by technological innovation, expanding application domains, and increasing institutional investment.

Regional Analysis: North America, Europe, Asia-Pacific, and Rest of World

The global quantum annealing hardware manufacturing landscape in 2025 is characterized by distinct regional dynamics, shaped by government investment, research infrastructure, and the presence of leading technology firms. The market is primarily concentrated in North America, Europe, and Asia-Pacific, with emerging activity in the Rest of World (RoW) regions.

- North America: North America, particularly the United States and Canada, remains the epicenter of quantum annealing hardware manufacturing. Companies such as D-Wave Systems have established North America as a global leader, supported by robust venture capital, public funding, and partnerships with academic institutions. The U.S. government’s National Quantum Initiative and Canada’s Quantum Strategy are driving further investment in R&D and manufacturing capacity. The region benefits from a mature semiconductor supply chain and a strong ecosystem of quantum software and service providers, accelerating commercialization efforts.

- Europe: Europe is rapidly scaling its quantum annealing capabilities, propelled by the European Commission’s Quantum Flagship program and national initiatives in Germany, France, and the UK. European manufacturers are focusing on collaborative research, with consortia such as Fraunhofer Society and Leonardo S.p.A. investing in quantum hardware. While Europe lags North America in commercial deployment, it is closing the gap through public-private partnerships and cross-border projects aimed at building scalable, fault-tolerant quantum annealers.

- Asia-Pacific: The Asia-Pacific region, led by Japan, China, and South Korea, is intensifying its focus on quantum annealing hardware. Japan’s RIKEN and NTT are at the forefront, with significant government funding and industry collaboration. China’s Origin Quantum and state-backed research centers are investing heavily in indigenous hardware development, aiming to reduce reliance on foreign technology. South Korea’s Samsung Electronics is exploring quantum annealing as part of its broader quantum computing strategy. The region’s manufacturing prowess and government support position it as a key growth market.

- Rest of World (RoW): In RoW, activity is nascent but growing, with countries in the Middle East and Latin America launching pilot projects and forming alliances with established players. Initiatives such as the Qatar Foundation and Brazil’s CNPq are exploring quantum research, though large-scale manufacturing remains limited.

Overall, regional competition and collaboration are accelerating innovation in quantum annealing hardware manufacturing, with North America maintaining a lead, but Europe and Asia-Pacific rapidly advancing through strategic investments and partnerships.

Future Outlook: Emerging Applications and Investment Hotspots

The future outlook for quantum annealing hardware manufacturing in 2025 is shaped by a convergence of technological advancements, expanding application domains, and intensifying investment activity. As quantum annealing matures beyond proof-of-concept systems, manufacturers are poised to capitalize on both established and emerging markets, with a particular focus on optimization, logistics, finance, and materials science.

Emerging applications are driving demand for more robust and scalable quantum annealing hardware. In logistics and supply chain management, quantum annealers are being piloted to solve complex routing and scheduling problems, offering potential cost savings and efficiency gains for global enterprises. The financial sector is exploring quantum annealing for portfolio optimization and risk analysis, with several pilot projects underway at major institutions. Additionally, materials science and drug discovery are leveraging quantum annealing to accelerate molecular modeling and simulation, a trend expected to intensify as hardware capabilities improve IBM.

On the manufacturing front, the race to develop next-generation quantum annealers is spurring significant investment in R&D and fabrication infrastructure. Companies are focusing on increasing qubit counts, improving coherence times, and reducing error rates. The transition from superconducting to alternative qubit technologies, such as photonic or spin-based systems, is also being explored to overcome current scalability limitations. These advancements are expected to lower the barriers to commercial adoption and broaden the addressable market for quantum annealing solutions D-Wave Systems Inc..

- Investment Hotspots: North America remains the epicenter of quantum annealing hardware investment, led by established players and a growing ecosystem of startups. However, Asia-Pacific, particularly Japan and China, is rapidly increasing its share of R&D spending and government-backed initiatives, signaling a shift toward a more globally distributed innovation landscape McKinsey & Company.

- Strategic Partnerships: Collaborations between hardware manufacturers, cloud service providers, and end-user industries are accelerating the commercialization of quantum annealing. These partnerships are expected to proliferate in 2025, enabling broader access to quantum resources and fostering co-development of industry-specific solutions Gartner.

In summary, 2025 will see quantum annealing hardware manufacturing at a pivotal juncture, with emerging applications and global investment hotspots shaping the competitive landscape and accelerating the path toward practical quantum advantage.

Challenges, Risks, and Strategic Opportunities

Quantum annealing hardware manufacturing in 2025 faces a complex landscape of challenges, risks, and strategic opportunities as the sector seeks to transition from research-driven prototypes to scalable, commercially viable systems. The primary challenge remains the extreme technical precision required for fabricating quantum annealers, particularly those based on superconducting qubits. Manufacturing processes must achieve nanometer-scale accuracy and ultra-low defect rates, as even minor imperfections can significantly degrade quantum coherence and system performance. This necessitates substantial capital investment in cleanroom facilities, advanced lithography, and cryogenic infrastructure, creating high barriers to entry and limiting the number of capable suppliers worldwide.

Supply chain risks are also pronounced. The reliance on specialized materials—such as high-purity niobium and rare isotopes—exposes manufacturers to potential shortages and price volatility. Geopolitical tensions and export controls on critical technologies further complicate sourcing, especially as governments increasingly view quantum technologies as strategic assets. For example, the U.S. and China have both implemented measures to secure domestic quantum supply chains, which could fragment global collaboration and restrict access to key components (U.S. Department of Commerce).

Another significant risk is the rapid pace of technological change. Quantum annealing competes with other quantum computing paradigms, such as gate-based systems and photonic approaches. Manufacturers must balance investments in current-generation annealers with the need to remain agile in adopting new architectures or materials that could render existing hardware obsolete. This risk is compounded by the uncertain timeline for achieving “quantum advantage” in commercially relevant applications, which affects customer demand and long-term revenue projections (McKinsey & Company).

Despite these challenges, strategic opportunities abound. Partnerships with cloud service providers and vertical industry leaders can accelerate adoption by integrating quantum annealing as a service, reducing the need for end-users to invest in hardware. Additionally, government funding and public-private consortia—such as those led by the National Science Foundation and European Quantum Communication Infrastructure—offer financial support and collaborative R&D environments. Manufacturers that invest in proprietary fabrication techniques, robust IP portfolios, and ecosystem development are well-positioned to capture early market share as quantum annealing moves toward broader commercialization in 2025 and beyond.

Sources & References

- D-Wave Systems Inc.

- Fujitsu

- Toshiba

- IDC

- IBM

- Google Cloud

- European Commission’s Quantum Flagship

- Fraunhofer Society

- Leonardo S.p.A.

- RIKEN

- McKinsey & Company

- U.S. Department of Commerce

- National Science Foundation